Roth 401k conversion tax calculator

Official Site - Open A Merrill Edge Self-Directed Investing Account Today. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

Roth Ira Conversion Tax Calculator Software

It increases your income and you pay your ordinary tax rate on the conversion.

. Boost Your Retirement Income. Updated May 2022 Roth vs. Make a Thoughtful Decision For Your Retirement.

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. When planning for retirement there are a number of key decisions to make. Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing.

This calculator will analyze your information and give you how much you could expect for each option you have which includes rolling over into a Roth IRA rolling over into another type of tax. As of January 2006 there is a new type of 401 k -- the Roth 401 k. Ad Boost Your 401k.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. The Sooner You Invest the More Opportunity Your Money Has To Grow. With the passage of the American Tax Relief Act any.

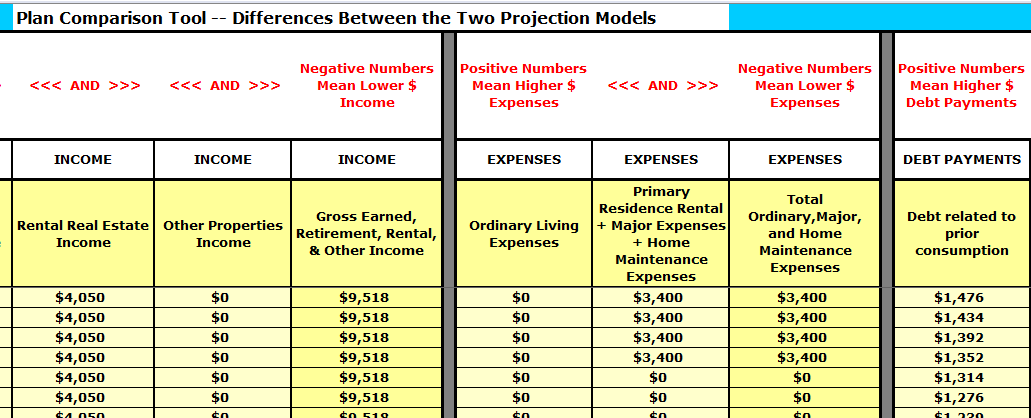

The VeriPlan Roth IRA conversion calculator feature running on Microsoft Excel functions as a Roth IRA predictor enabling year-by-year Roth conversion analysis. Use this Roth IRA conversion calculator to project the inflation-adjusted value of your Traditional IRA or 401k at retirement versus the inflation-adjusted value of the same funds at retirement. Ad Open an IRA Explore Roth vs.

Roth 401 k Conversion Calculator This calculator will show the advantage if any of converting your pre-tax 401 k to a Roth 401 k. Discover How Much to Convert 2022 Roth Conversion Calculator This calculator can help you make informed decisions about performing a Roth. This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax-deferred account until retirement.

Roth 401 k Conversion Calculator Definitions Please note the following important information regarding any Roth conversion You must pay ordinary income tax on the amount converted. A conversion has both advantages and disadvantages that should be carefully considered before you make a decision. Take Control Of Your 401k.

Your income for the tax year will. As of January 2006 there is a new type of 401 k contribution. This calculator compares two alternatives with equal out.

First enter the current balance. The Roth 401 k allows you to contribute to your 401 k account on an after. This convert IRA to Roth calculator estimates the change in total net worth at.

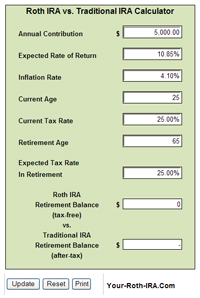

Register For A Free Webinar Now. Roth IRA Conversion Calculator Is converting to a Roth IRA the right move for you. Traditional 401 k and your Paycheck A 401 k can be an effective retirement tool.

This calculator will help you to compare the net effects of keeping your traditional Individual Retirement Account. Ad Learn More About Our Roth Traditional IRA Accounts Well Help You Roll Over Your 401K. A conversion has both advantages and disadvantages that should be carefully considered before you make a decision.

This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. Otherwise you would do so and you. One big decision is whether or not you should convert your traditional IRA into a Roth IRA.

Traditional 401 K Or Roth 401 K Calculator Calculate your earnings and more A 401 k can be an effective retirement tool. Call 866-855-5635 or open a Schwab IRA today. Sign Up For A Free IFW Webinar Today.

2022 Roth Conversion Calculator. Live Your Best Life In Retirement. Although it is possible to convert an IRA at any age this calculator does not take Required Minimum Distributions RMD into account which begin at age 72 or 70 12 if you were born.

Say youre in the 22 tax bracket and convert 20000. A conversion has advantages and disadvantages that should be carefully considered before a decision is made. This calculator compares two alternatives with equal out of pocket costs.

Use our Roth IRA Conversion Calculator Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your. Traditional or Rollover Your 401k Today. Roth IRA Conversion Calculator to Calculate Retirement Comparisons.

This calculator compares two alternatives with equal out of pocket costs. This calculator can help you decide if converting money from a non-Roth IRA s including a. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

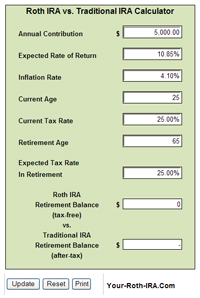

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Excel Template For Free

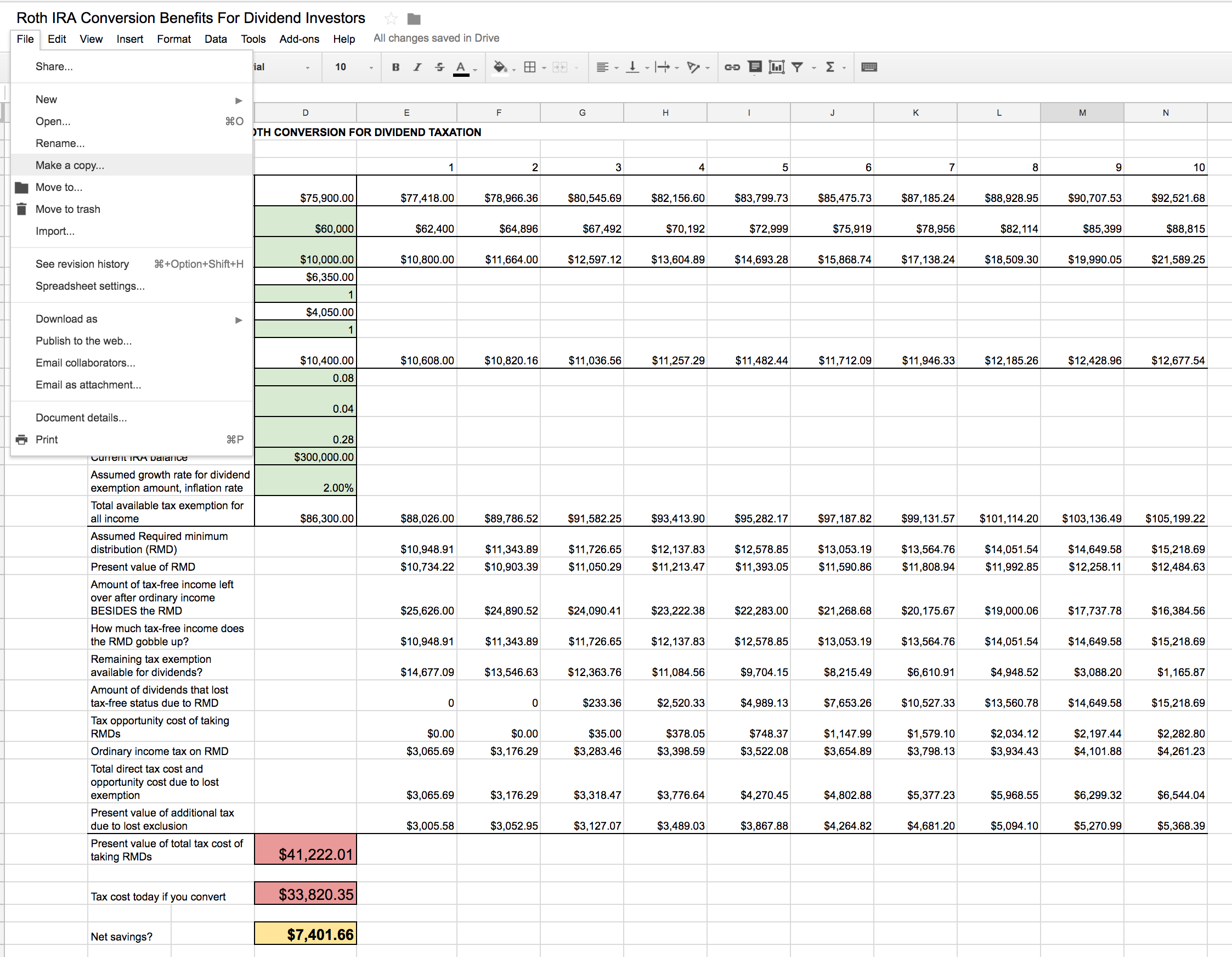

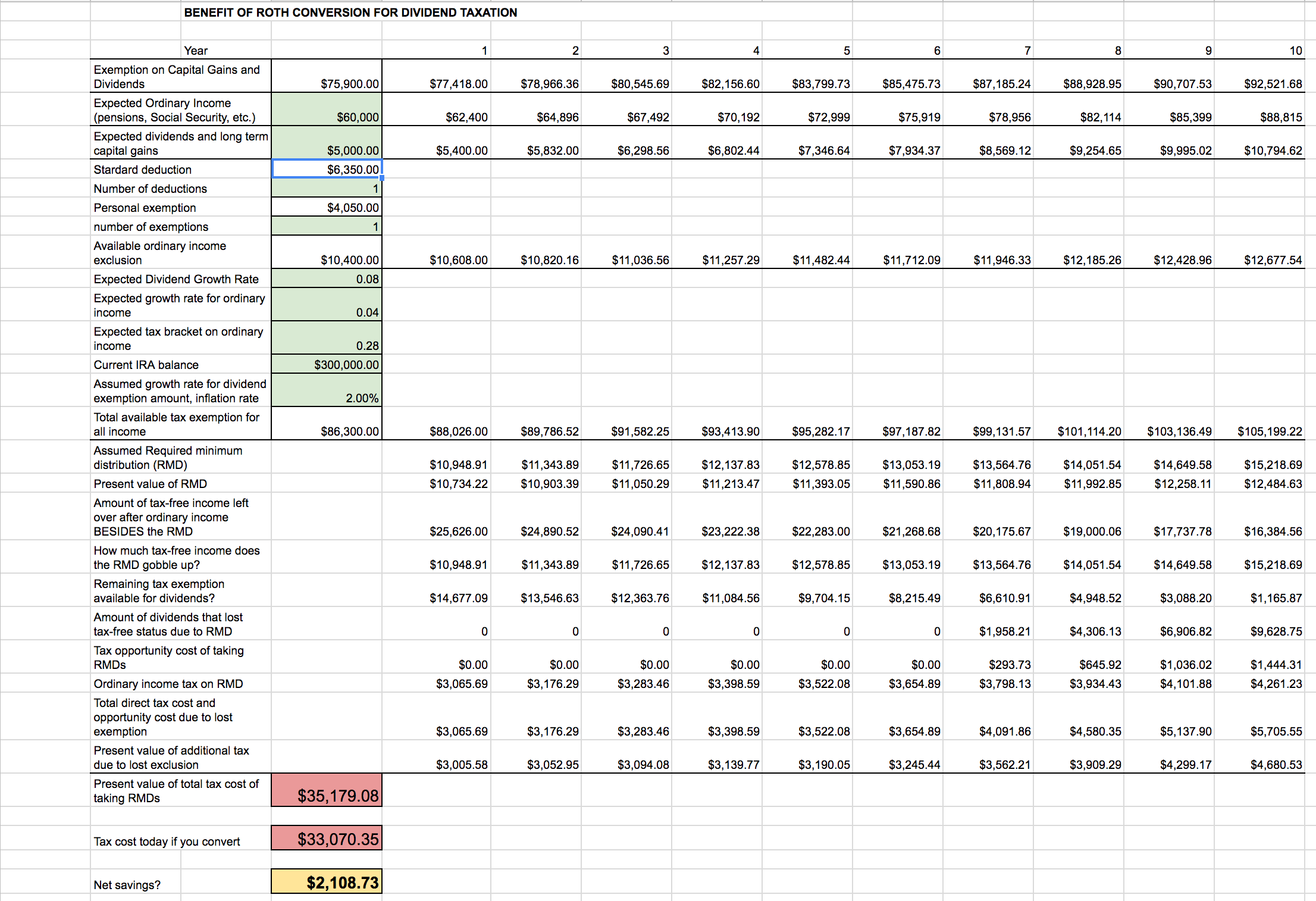

Roth Ira Conversion Spreadsheet Seeking Alpha

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Conversion 2012 Roth Calculator For Prof Low Income Marotta On Money

Diy Roth Conversion Engine Template Bogleheads Org

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Conversion Spreadsheet Seeking Alpha

Roth Ira Calculators

Roth Ira Conversion Calculator Excel

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Download Roth Ira Calculator Excel Template Exceldatapro

Traditional Vs Roth Ira Calculator

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Roth Ira Calculators

Systematic Partial Roth Conversions Recharacterizations